Risk management is one the most important internal processes both in PKO Bank Polski SA including the Bank's abroad and in other entities of the PKO Bank Polski SA Group. Risk management aims at ensuring profitability of business activity, while ensuring control of the level of risk and maintaining it within risk tolerance and limit system adopted by the Bank, in the changing legal and macroeconomic environment. The level of the risks is an important component of the planning process.

In the PKO Bank Polski SA Group, the following types of risk have been identified, which are subject to management: credit risk, interest rate risk, currency risk, liquidity risk, commodity price risk, price risk of equity securities, derivative instruments risk, operational risk, compliance risk, risk of macroeconomic changes, model risk, business risk (including strategic risk), reputation risk, excessive financial leverage, capital and insurance risk.

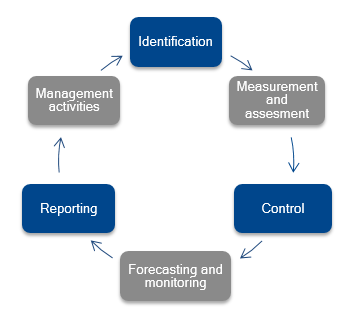

The risk management process is described on the chart below:

Risk management in the Group is based especially on the following principles:

- the Group manages all of the identified types of risk,

- the risk management process is appropriate to the scale of the operations and to the materiality, scale and complexity of a given risk and tailored to new risk factors and sources on a current basis,

- the risk management methods (in particular the models and their assumptions) and the risk measurement systems are tailored to the scale and complexity of the risk and verified and validated on a periodical basis,

- the area of risk and debt recovery remains organisationally independent from business activities,

- risk management is integrated with the planning and controlling systems,

- the risk level is monitored on a current basis,

- the risk management process supports the implementation of the Group’s strategy in compliance with the risk management strategy, in particular with regard to the level of tolerance of the risk.

The risk management process is supervised by the Supervisory Board of the Bank, which is informed on a regular basis about the risk profile of the Bank as well as of the PKO Bank Polski SA Group and the most important activities taken in the area of risk management.

The Bank’s Management Board is responsible for the risk management, including supervising and monitoring of activities taken by the Bank in the area of risk management. The Bank’s Management Board takes the most important decisions affecting the risk level of the Bank and enacts internal regulations regarding the risk management.

The risk management process is carried out in three, mutually independent lines of defence:

- the first line of defence, which is functional internal control that ensures using risk controls mechanisms and compliance of the activities with the generally applicable laws,

- the second line of defence, which is the risk management system, including methods, tools, process and organisation of risk management,

- the third line of defence, which is an internal audit.

The independence of the lines of defence consists of preserving organisational independence in the following areas:

- the function of the second line of defence as regards creating system solutions is independent of the function of the first line of defence,

- the function of the third line of defence is independent of the functions of the first and second lines of defence,

- the function of managing the compliance risk reports directly to the President of the Management Board.

The Bank supervises activities of the individual subsidiaries of the PKO Bank Polski SA Group. As part of this supervision, the Bank. The Bank also supervises the entities’ risk management systems and provides support in the development of these systems. Additionally, it reflects business risk of the particular entities in the risk reporting and risk monitoring system of the entire Group.

The internal management regulations of certain types of risk in the Group entities are defined by internal regulations implemented by those entities, after consulting the Bank’s opinion and having taken into account the recommendations issued by the Bank. The internal regulations of the entities concerning risk management are introduced based on consistency principle and comparable assessment of particular types of risk within the Bank and Group entities, including the scope and nature of the link entities included in the Group, the specificity and scale of the entity’s activity and the market on which it operates.

The top priority of the PKO Bank Polski SA Group is to maintain its strong capital position and to increase its stable sources of financing underlying the stable development of business activity, while maintaining the priorities of efficiency and effective cost control and appropriate risk assessment. For this purpose the Group has taken the following activities in 2015:

- in February, May and November 2015, turned the maturing own short-term bonds to a bonds with a maturity from three to six months in the amounts from PLN 800 million to PLN 1 billion,

- in October 2015, acquired financing due to issuance of short-term bonds with a maturity of six months on domestic market in the amount of EUR 200 million,

- reduced level of risk-weighted assets. The most important source of optimization carried out to improve the quality of data (eg. Inclusion in the category of retail exposures all SME customers meeting the criteria of segmentation), and a review of off balance-sheet liabilities, including verification of assigned risk weights of the product,

- The Bank accounted the net profit of 2015 to own funds in amount of PLN 3 079 million and retained profit from previous years in the amount of PLN 132.8 million, allocating them in accordance with the recommendation of the Management Board for capital reserves and leaving the amount of undivided 1 250 million PLN, without committing any sums the payment of dividends,

- PKO Bank Hipoteczny SA made the first issue of mortgage bonds – in the amount of PLN 30 million for 5 years period.

In 2015, the area of operational risk management, the Bank carried out preparatory works for the launch of the new Bank’s branch in the Federal Republic of Germany, which the opening took place in December 2015. As the part of the works in July 2015, the Bank obtained the permit of the Polish Financial Supervision Authority’s on the combined use of the Advanced Measurement Approach (AMA) and the Basic Indicator Approach (BIA) for calculating the own funds requirement in respect of operating risk. The BIA approach will be used to calculate the requirement for operational risk with regard to the activities of the branch of the Bank in the Federal Republic of Germany.

With the beginning of 1 April 2015, the PKO Bank Hipoteczny S.A started its operational activity. The Bank is a 100% subsidiary of PKO Bank Polski. It specializes in providing mortgage loans for individual clients. Extension of the Capital Group of PKO Bank Hipoteczny SA had no effect in 2015 on change of the nature of the risks identified within the framework of its activities.

The acquisition in the second half of 2015 of Spółdzielcza Kasa Oszczędnościowo Kredytowa “Wesoła” in Mysłowice, has not changed the nature of the risks identified in the Bank’s activities. Within the Capital Group, the portfolios of mortgage loans granted by PKO Bank Polski will be moved to the PKO Bank Hipoteczny. The value of portfolio transferred in 2015 (transfer took place in December) amounted to PLN 400 million.

In the second half of 2015 PKO Leasing Group continued to integrate risk management approach of PKO Bank Polski in adapting internal regulations. In addition, measures have been taken to standardize the processes and management of PKO Leasing with PKO factoring. PKO Leasing Group uses the results of the analysis of creditworthiness of customers resulting from the Bank’s rating model for the assessment of clients in full procedures, implements antifraud model and improves impairment model.

In 2015, Kredobank SA make changes in order to optimize and increase the efficiency of the credit process.