The development directions of PKO Bank Polski SA was set out in the new strategy for the years 2013-2015, ‘PKO Bank Polski. Daily the best’, approved by the Supervisory Board on 27 March 2013.

PKO Bank Polski SA’s vision for development is based on the assumption that its market financial sector leader position in Poland and a leading universal bank in Central Europe should be maintained. At the same time, while ensuring:

- efficiency, building sustainable values and conducting a stable dividend policy for the shareholders,

- customer satisfaction resulting from credibility, a product offer tailored to the customers’ needs and professional service,

- the image of a reliable partner involved in long-term relationships with business partners and local communities,

- the position of the best employer in the Polish banking sector, which supports development and common values.

The strategy assumes strengthening the position of PKO Bank Polski SA brand as the most valuable brand in the Polish banking sector. Its strength results from such aspects as: its Polish character, the safety and long-term trust of its customers, as well as professional service, modern product offer, innovation and new technologies.

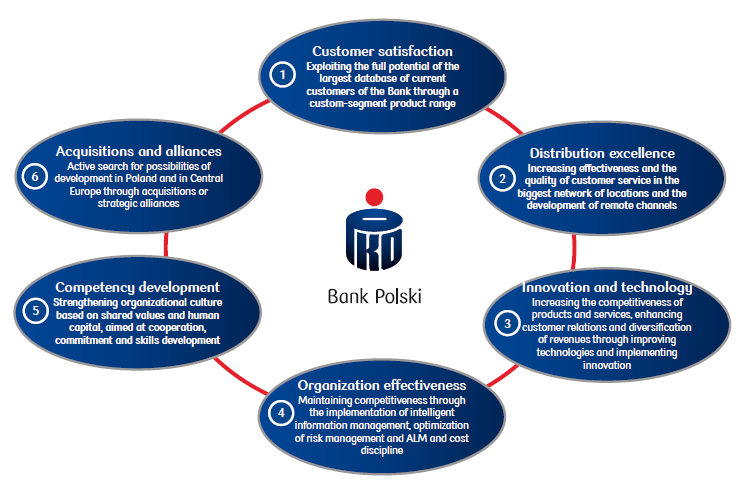

The implementation of the Bank’s development vision was supported by the long-term strategic levers which were a part of the strategy, such as:

Long-term strategic levers contribute to the leverage of the following areas of business:

1) Strategic levers in Retail Banking:

- Customer-centric approach (using the information about the customer to provide a better service);

- Distribution excellence (improved distribution effectiveness, network modernisation and optimisation, development of direct channels, improvement in selling skills and sales effectiveness);

- Innovation and diversification of revenues (implementation of the innovation portfolio management model and development of non-interest income streams).

2) Strategic levers in Corporate and Investment Banking:

- Relationship banking and segment-based service model (implementation of an improved segment strategy, distribution structure and price policy and development of skills, as well as loan portfolio quality discipline and efficient capital allocation);

- Transaction banking (development of mass payment solutions, extending the product offer, improving customer service quality and improving of processes);

- Integrated sales model - capital markets and structured financing (implementing the cross-selling model and developing investment products);

- Optimisation of assets and equity and liabilities management (safe and effective management of the Bank’s liquidity, improving the interest rate risk management, developing long-term financing, developing the Group);

3) Strategic levers of Supporting Areas:

- Risk management optimisation (decreasing credit risk costs, process enhancement, implementing price policies adjusted to the customer’s risk profile, implementing IRB method and increasing the rate of return);

- Advanced, efficient and safe technologies and efficient operating processes (IT solutions supporting ‘business activities’ in the development of new products, creating conditions for the further, safe development of the Bank’s business activities);

- Development through increased involvement and common values (increasing organisational efficiency and human capital value, enhancing corporate culture which is open to changes, attracting the best employees);

- Efficient financial management (increasing financial management efficiency through perfecting organisational intelligence, introducing new methods of the Bank’s statement of financial position management and continuous cost optimisation).

Another strategic lever of development of PKO Bank Polski SA are acquisitions, comprising:

- domestic acquisitions, offering an opportunity to achieve synergies and strengthening the position on the domestic market in the period of slow-down of the market growth,

- international acquisitions, associated with seeking growth on faster-growing markets and the opportunities to use the Bank’s international experience and competencies.

As part of the strategy of PKO Bank Polski SA an integrated model of the Group was developed. The Bank’s subsidiaries, acting as product centres, supplement the basic offer of the Bank’s financial products in respect to leasing, factoring, investment and pension funds and insurance.

The key strategic initiatives for the Group’s model development for 2013-2015 comprised:

- optimisation of operational links within the Group by integration of selected companies with the Bank or the other Group entities – transfer of activities and centralisation of support functions,

- sale of assets which are not associated with the Bank’s core activity,

- ensuring security and careful development of KREDOBANK SA focused on providing services to retail customers and small and medium enterprises operating mainly in western Ukraine and in Kiev,

- establishment of a mortgage bank,

- implementation of a new bancassurance model,

- strengthening the Group’s market position in selected market segments, also through alliances in the area of payments and acquisitions of companies.